There are three ways you can add an investment to your Investment Library. You can:

- Click Add investment and create a new investment from scratch by manually adding the data.

- Clone an existing investment that’s already saved in your library and then edit the data as required.

- Use Genovo’s Bulk Investment Importer to upload investments to your library from a csv file.

Cloning an investment is a particularly quick and efficient way of adding several investments to your Investment Library where the information about each investment is similar. For example, a range of risk-rated model portfolios where the underlying funds, with a handful of exceptions, are broadly similar, and the allocations are slightly different.

The Bulk Investment Importer allows you to upload up to 50 investments into your library at one time. In the first instance you’ll need a csv file of the investment-related data you wish to import. This is likely to be achieved by exporting the data from a separate app such as FE Analytics or Morningstar Advisor Workstation.

What sort of information should you include for an investment?

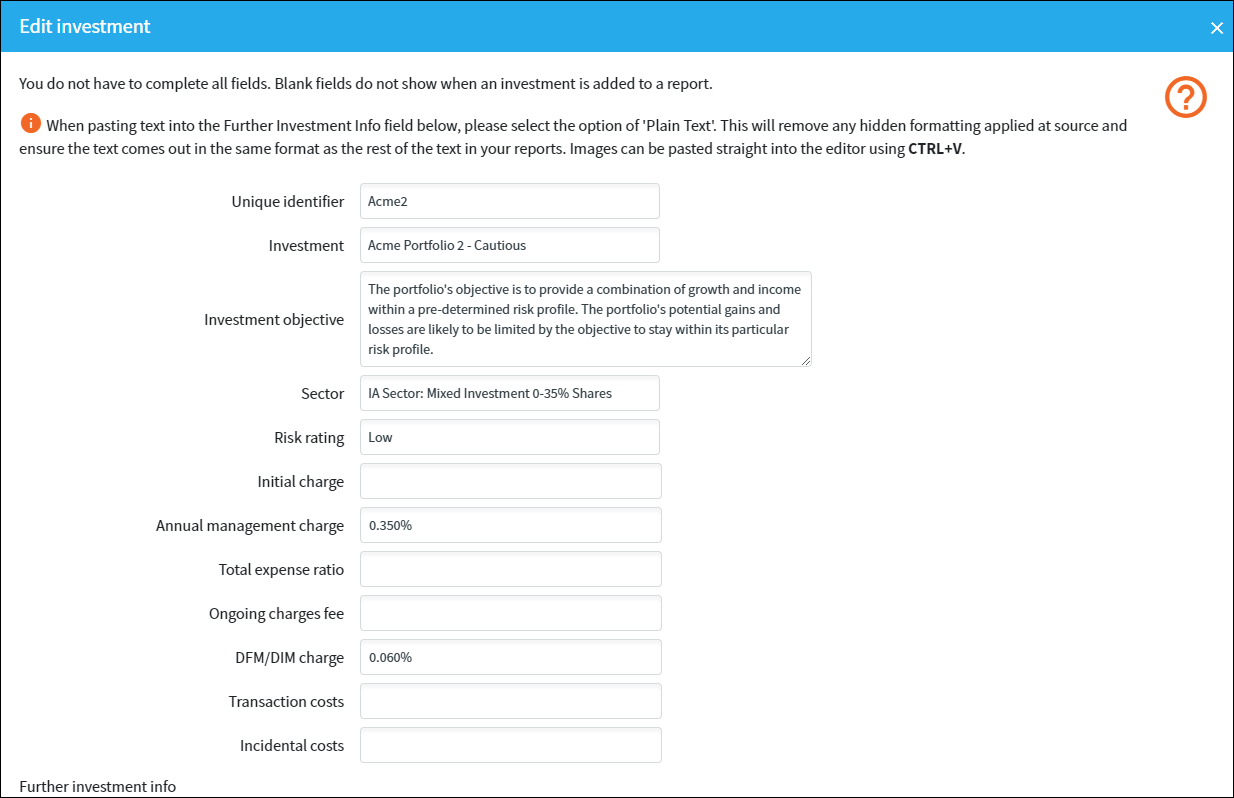

Genovo’s Investment Library has been deliberately designed to allow every one of our 4000+ users to include as much or as little information about a particular investment as they want / need to include in their reports, and hence the input screen for an investment looks like this.

However, it is important to note that when you add an investment into your Investment Library, it is neither compulsory, nor expected that you will complete all fields. In fact, the fields that you choose to complete for a particular investment will depend on:

- The type of investment it is.

- The level of detail you wish to include in your reports when you recommend that particular investment to a client.

Type of investment

Some fields aren’t relevant for certain types of investment. For example, the 'Sector' field isn’t relevant for a model portfolio and the 'DFM / DIM Charge' field isn’t going to be relevant for a fund.

Likewise, some of the fields have been included as an either / or. For example, although we provide the facility to include the 'Annual Management Charge', the 'Total Expense Ratio' and the 'Ongoing Charges Figure' for a particular investment, these are all variations on the same theme (i.e. the ongoing charge of an investment) and it is most likely that only one of these will actually be quoted for a particular investment.

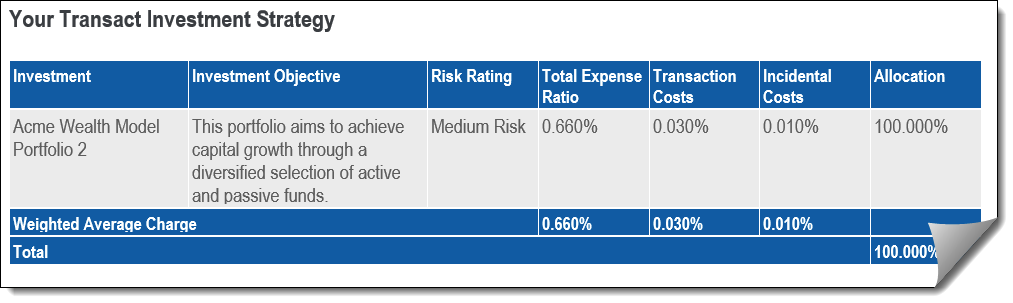

If a field isn’t relevant or isn’t required, just leave it blank. Moreover, empty fields won’t be included in the investment strategy table that’s automatically inserted in your report, thereby saving you the time and hassle involved in reformatting it to remove any empty / irrelevant columns.

Level of detail

We are also conscious that not everyone wants / needs to include the same level of detail about an investment in their reports, and I hasten to add, there is no right or wrong approach to this.

For example, when recommending a model portfolio, if you’re providing your clients with a detailed portfolio fact sheet, you may only want to include the core high-level key information about the portfolio (e.g. portfolio name, risk rating and overall OCF) in your reports and signpost the reader to the accompanying portfolio factsheet for further information. In such an instance it is only the core high-level key information that you’re probably going to want include in your Investment Library.

Others may want to also include more granular detail about the asset allocation and / or the underlying funds that make up the model portfolio in their reports and hence this additional information should be added into their Investment Library too.

Of particular note for those who do wish to include more detailed information about a particular investment in their reports is the 'Further Investment Info' field at the bottom of the page.

This is a catch-all field where you can add any additional information about the investment that isn’t covered by the other fields. For example, this could be some background information about the investment provider, an asset allocation pie chart, or a table of the underling investments that make up the model portfolio. The real takeaway here is that anything you add into the 'Further Investment' Info field will be automatically pulled through into your reports and automatically inserted under the Investment Strategy table whenever this investment is added to an investment strategy.

You'll find further about how to add an asset allocation pie chart and table detailing the funds that make up a portfolio to an investment in your Investment Library in this article.

What sort of information should I include in the various fields?

Unique identifier - This field wont come out in your reports but it does allow you to distinguish between funds / investments by adding the ISIN, SEDOL, or your own descriptive name to the investment. This could be particularly useful when you want to differentiate between multiple classes of the same fund, or the same fund held on different platforms.

Investment - This is the name of the investment

Investment objective - This is a brief objective of the investment e.g. "To provide capital growth...."

Sector - This will only be relevant for funds.

Risk rating - This could be a number or a descriptive word.

Initial charge - This relates to any initial charge incurred on the investment.

AMC, TER, OCF - These relate to the ongoing investment management charges of the investment.

DFM / DIM Charge - If the underlying investment is a DFM or DIM, this is where you can include any additional charge specifically levied by the DFM / DIM manager.

Transaction costs - All costs and charges that are likely to be incurred as a result of the acquisition and disposal of the investment.

Incidental costs - Any other investment-related costs and charges that aren’t covered by the other fields.

Should you include performance charts in the Investment Library?

Given performance data is dynamic and will quickly go out of date, we wouldn’t recommend adding performance data into the Investment Library.

However, when you create a Current Investment Strategy (review sections) or Recommended Investment Strategy (Recommended Investment Strategy section) in a report for a client, this is exactly the kind of information that you may wish to add into the text box at the bottom of the page.